Asset Backed Lending in Commodity Finance: Collateral Analysis, Valuation, and Maintenance

A well-established due diligence process is important for every investor. This process should be documented and formalized. This ensures every member of the investment team works towards the same end in an efficient and organized manner. The process should not be so rigid that distinctive analysis required by a particular transaction is not welcomed. Creative approaches to analysis outside of the core process should be encouraged. The investor’s due diligence process should be malleable enough that it is re-examined and edited periodically. It is by this iterative approach and over the course of many years that we’ve established a thorough and respected due diligence process.

In this whitepaper we will explore one of the pieces of our due diligence process. That is, our approach to collateral analysis as it applies to loans backed by agricultural commodities. We will address collateral analysis of fixed assets along the agricultural supply chain in a separate whitepaper. Here, we will start with the aspects we use to define the agricultural collateral for each transaction: commodity type, commodity location, and legal structure, digging into each. Then we will bring them together in a holistic assessment, where we will use a real example along with the investment decision and structuring considerations. Lastly, we will touch on valuation and maintenance of the collateral underpinning these loans.

Aspects of Collateral

We remind the reader that this paper deals exclusively with agricultural commodities; however, the ideas and methodology are equally applicable to most other commodities.

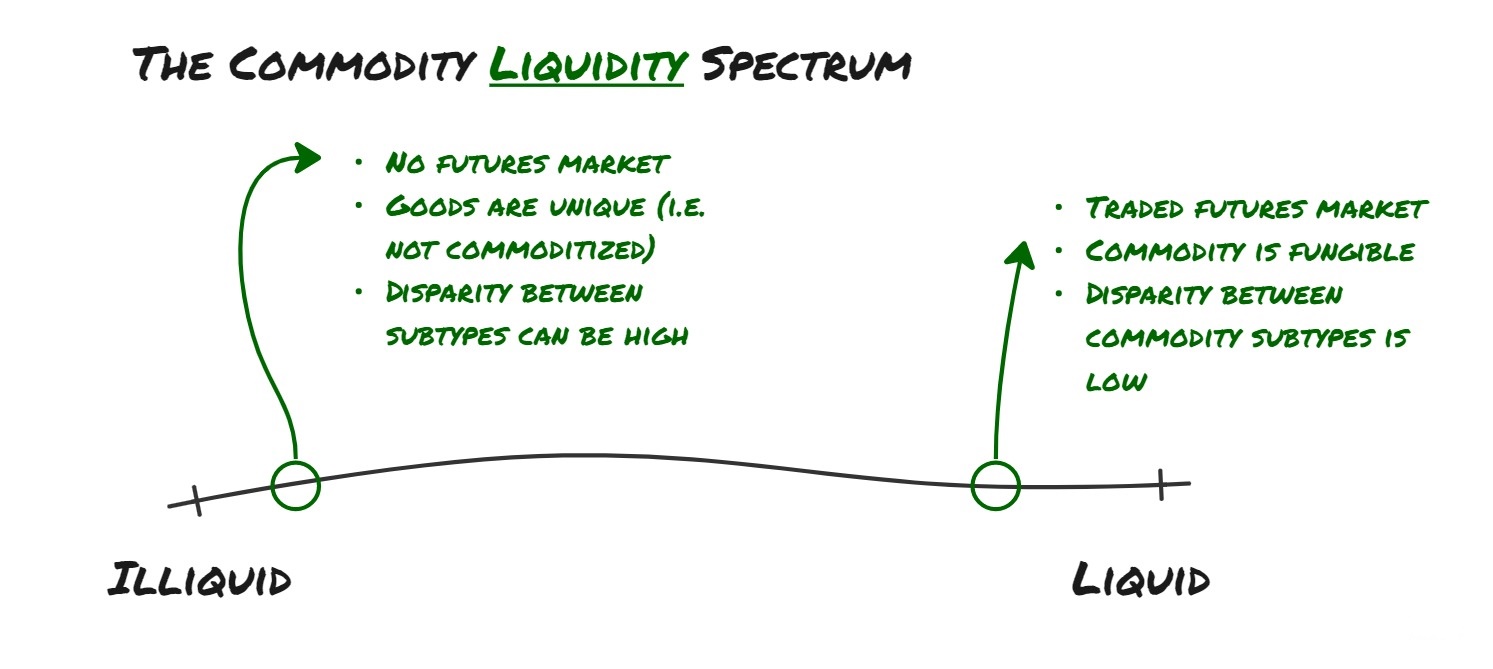

(1) Commodity Type: We distinguish collateral type first by its liquidity. A liquid agri-commodity being one that is fungible and has a relatively active futures market. Some examples of these are grains like corn and wheat; oilseeds, like soybean and rapeseed, along with their oils and meals; as well as sugar, coffee, and cotton. Further down the spectrum of liquidity are agri-commodities that lack an active futures market or the fungibility to be reliably included in that market. For instance, lumber may have active futures, but due to the numerous qualities and cuts in which it can be sold, it lacks fungibility, thus reducing the market size into which this asset can be sold. To elaborate, a collateral package that includes lumber will likely have a variety of different sub-types, distinguished by size, shape, and type of wood. While their prices will be correlated to an active futures market, these prices will be less reliable in a scenario where the creditor is selling the physical asset. The multitude of subtypes means fewer buyers exist for the whole package, or alternatively for each subtype. These dynamics increase selling costs and reduce negotiating power with buyers, leading to bigger discounts in a practical scenario. One can imagine that selling an entirely homogeneous batch of corn or soybean is far easier due to the multitude of buyers globally and the clear relationship to a traded futures market.

Commodities that are less liquid can still be reliably used as collateral but require a different approach. First, because we know that the cost of selling these goods is elevated and buyers will negotiate bigger discounts, we need to ensure that overcollateralization is higher than if it were a very liquid product. Second, we need to establish potential buyers ahead of time, so that if a sale is required the process is as frictionless as possible. In establishing this list of buyers, we should consider the quality of each counterparty, their ability to purchase goods in adequate volume, whether they have an existing relationship with the supplier (that is, the borrower) and the quality of that relationship. More buyers of diverse origin will improve the collateral quality. Too few buyers of an asset that looks increasingly more unique than commoditized can make collateral unacceptable.

Finding buyers starts with the borrowers list of offtakers, but also includes the underwriter’s own existing relationships. As this list is established during the due diligence process, we recommend speaking directly to buyers to build relationships early on. In these conversations we discuss what a potential sale of assets would look like under an enforcement scenario and where the lender delivers to the offtaker. This helps establish the willingness of the buyer, the typical discount they’d ask for in such a scenario, and other sales costs. In accumulating this data, we arrive at a range of discounts and costs, which we can use to help set an overcollateralization level that covers them.

The same analysis should take place for liquid commodities, although a list of potential buyers is in fact a list of the globe’s biggest trading houses along with numerous companies in their own localities. For a new lender in the space, start here, establish these relationships early, as they’ll apply to the majority of your investments. As agricultural specialists we retain these relationships on an ongoing basis. For liquid commodities there are numerous available buyers, and sales costs and discounts are far less in an enforcement and sales scenario.

Liquid commodities are also more readily accepted as collateral by traditional financiers. Thus, borrowers expect overcollateralization levels to be lower than if the goods held as collateral were less liquid. To accept lower overcollateralization levels, we perform variance analysis on commodity prices. In this analysis we test that current price levels are not too high and that the collateral buffer is sufficient to absorb reasonably expected price downturns.

When considering collateral type, regardless of liquidity, we examine the collateral’s economic state. That is, an examination of supply and demand dynamics locally and globally, and a view of price expectations over the tenor of the loan. The underwriter must recognize that commodity cycles can affect the borrower and the value of collateral simultaneously. Therefore, prudence must be taken in selecting the underlying commodity for a transaction. Similarly, commodities that the investment team believes will outperform should be favored. This macro analysis is an ongoing process required in managing an existing set of loans, building a pipeline, and executing new transactions.

We focus ourselves on commodities whose stocks-to-use and price are both historically low, so that upward price pressure is highest. These two factors should be considered together. The former is effectively a measure of scarcity, and thus we want to invest in areas where commodities are relatively scarce but whose prices do not reflect that. A commodity that is lacking scarcity and whose prices are high is a dangerous place to be invested. Other permutations of these variables are generally fair.

Lastly, preference should be for commodities where there is the least possibility of outside intervention, whether it be from government, regulatory bodies, or advocacy groups. A free market is far more predictable and less prone to shocks.

A commodity that is lacking scarcity

and whose prices are high

is a dangerous place to be invested.

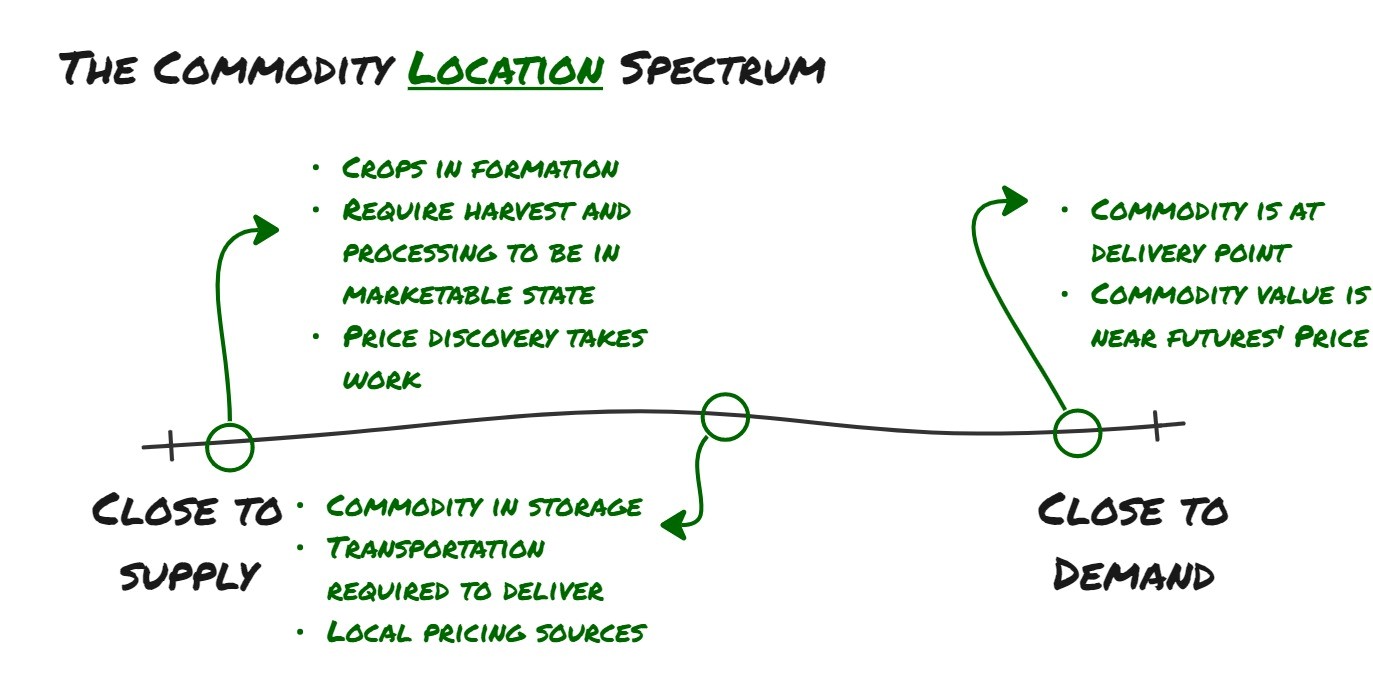

(2) Commodity Location: Those commodity experts reading “location” will first think of basis spreads. That is, the difference in price between a commodity in two different locations. A ton of soybean in Mato Grosso is not worth an equal amount as the same ton of soybean at the Port of Santos. The difference being the cost to move the goods between locations. In other words, bringing the goods further from the point of supply and closer to point of demand has value. In our analysis of location, we will expand this idea of basis from marketable goods held as inventory to also include commodities that are in formation: commodities that are still crops, not yet fully grown. The reason location is important is to properly value and price commodities held as collateral, but also to assess the potential frictions of selling the goods. Like with our spectrum of liquidity, we think of location on a spectrum from its point of supply to its point of highest demand. The closer we are to demand, the higher the collateral quality.

When measuring the impact of location on value of collateral, there are two approaches. The first is finding a reliable source for pricing in that locale. In geographies with a very active physical market, there are numerous sources. For example, there are publicly available prices for all of Brazil’s key export crops in most of the locations where these commodities are grown. If publicly available sources are not reliable, then speaking with local traders who are actively buying goods is another approach to price discovery. Some traders post daily prices on their website or inside of chat groups for deliveries to their storage facilities daily. If no reliable pricing source is available, we turn to our second approach.

The relevant basis spread for our analysis is an aggregation of the costs to bring goods from where they are to where a bid exists. Therefore, if no reliable price exists, we calculate costs to bring the commodity from where it is to where it needs to be to consummate a sale. For instance, there exists a reliable bid for a bale of cotton fiber at the Port of Santos. With this price in hand, we work backwards, to calculate the cost of transportation, insurance, and loading to get the cotton to this delivery point. If the cotton is unharvested, we incorporate costs of harvesting and processing as well.

We do not mean the above analysis to convey that basis spreads can be calculated by merely adding up costs. The basis spread can also include some premium (or discount) on top of these costs, which depends on market conditions of supply and demand. For our analysis however, we go through the case where we must enforce and move collateral to a place where it can be sold to make the investment whole.

Working through the costs of bringing goods from where they are to where they can be sold will introduce the real-life frictions of performing this work. Consider these frictions in the quality of the collateral. Each has an associated monetary and timeliness cost, and each additional phase adds some friction. These frictions and costs need to be understood and documented, as well as different permutations of how a sales scenario looks. The flexibility to sell goods close to its supply or closer to its key delivery points exists, with the difference being the number of available buyers and size of discount. In general, we recommend accommodating for discounts in collateral coverage ratios and valuation so that in a practical scenario goods can be sold ex-works without having to deal with frictions such as transportation and harvest.

In general, we prefer for our collateral to be close to key delivery points. In other words, an important variable in the quality of collateral is proximity to nodes along the supply chain with the greatest volume for that commodity. The greater the volume of trade within proximity of goods, the higher the quality of collateral. This does not make collateral held as crops or far from delivery points unacceptable. The approach in these cases is to accommodate the collateral coverage for these added costs, or alternatively compensate for these costs when valuing collateral.

The greater the volume of trade within proximity of goods,

the higher the quality of collateral.

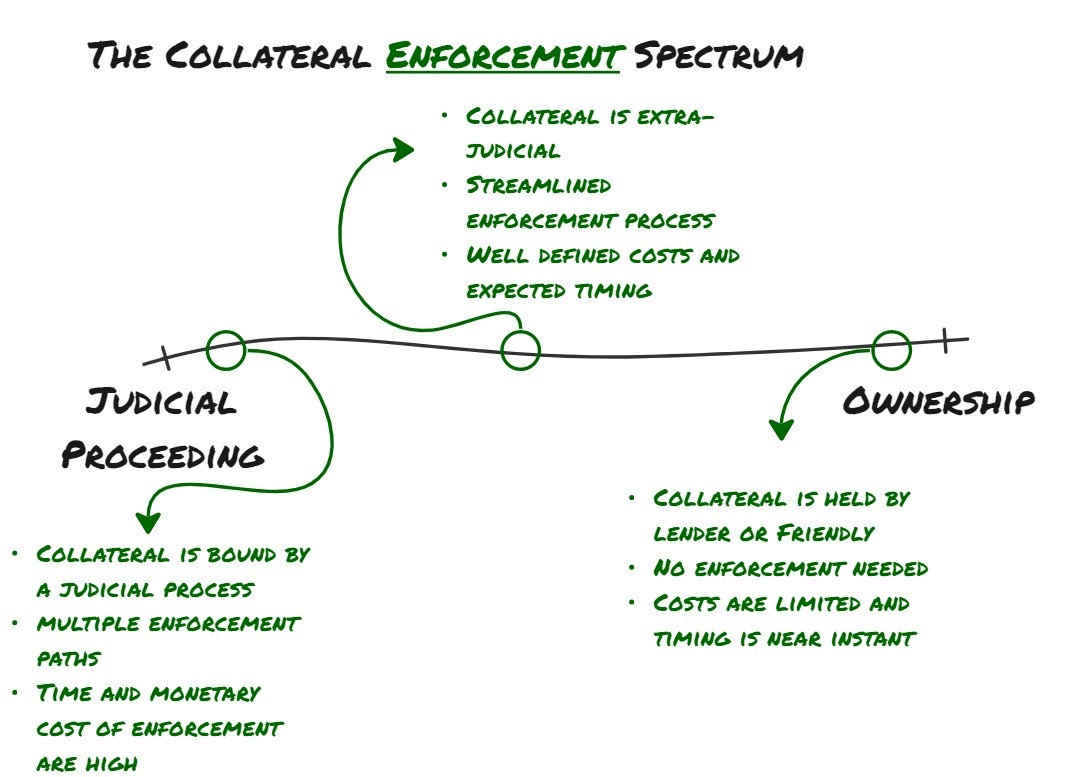

(3) Legal Structure: In measuring liquidity of the underlying commodity, along with its proximity to a sales point, we are solving for how we turn these assets into cash to fulfill outstanding loan obligations. In all cases the legal structure we use to collateralize the commodity is likely the most important aspect. In an enforcement scenario, the process which is most efficient is the one that is reliable and timely. Often, these two factors are correlated, as the fastest enforcement process is likely the most reliable.

We consider the available legal structures across a spectrum, from outright ownership to liens subject to a judicial process when they need to be enforced. The closer the structure is to ownership, the higher the collateral quality. We will describe structures along this spectrum starting from closest to ownership and moving further away towards traditional structures. Our focus remains strictly on the timing and cost of enforcement, as it pertains to the collateral.

Outright ownership structures are often repo transactions, where the lender holds the goods against a contract that the borrower will repurchase them at a future date. In these structures the enforcement process should be near instant, as the lender retains the right to sell the goods elsewhere once a default has occurred. With the goods already legally in the lender’s possession, that sales process should have few legal frictions.

Trusts are an example of what we consider quasi-ownership structures. Goods held as collateral are owned by the trust, which is under the purview of a friendly third-party trustee. In our experience these structures give the lender a comfortably reliable structure to get its hands on the collateral quickly if needed. The trustee is the only party that needs to be relied on in these enforcement scenarios. Hiring a professional third-party trustee and communicating on the intended enforcement process ahead of time is important to facilitate the process in the event it arises.

Beyond this but before more traditional tools, there are streamlined enforcement structures. These are extra-judicial collateralization tools that have priority ahead of typical liens and mortgages. They benefit from their own judicial process that is usually bankruptcy remote, thus making the enforcement process fractional compared to a normal multi-year reorganization. Most prevalent along the supply chain, in Brazil is a well-respected double warehouse receipt system, underpinned by the Certificate of Agricultural Deposit and Agricultural Warrant (CDA/WA). Similar warehouse receipt systems exist across Latin America, which we’ve used in Peru and Paraguay in particular, as well as in Eastern Europe. While each jurisdiction has its nuances, the enforcement of these instruments is significantly quicker than those subject to the entirety of the judicial appeals process. In our experience these structures can be enforced as timely as within a few weeks.

Finally, we have what we’ve referred to as traditional structures, or those that are subject to a regular legal process. When it comes to movable commodities, these are typically pledges or liens depending on the jurisdiction. These are the most common structures in the market. In considering these we include in our due diligence the different permutations of enforcement including timing and cost scenarios. These costs should be part of the methodology for setting overcollateralization levels.

Preference should always be for collateral that is closest to outright ownership. However, unlike commodity type and location, which are often an unchangeable function of the borrower’s underlying business, legal structure is subject to negotiation. Lending against commodities is lending against movable assets that are part of the borrower’s working capital, thus the borrower will want as much flexibility as possible. This is understandable; thus, the lender must acknowledge what degree of flexibility is required by the underlying business and then negotiate a legal structure that is best for them but without infringing upon the minimum degree of required flexibility. By accommodating for the borrower’s working capital cycles, the lender reduces operational risks that can occur when goods are not moving through the borrower’s supply chain in a timely fashion. Moreover, working capital assets are exceptionally important for the same reason, and thus act as strong collateral.

… accommodating for the borrower’s

working capital cycles

reduces operational risks…

Analyzing Collateral Holistically

We’ve introduced the three aspects of collateral and developed a quality spectrum for each: liquidity, location, and enforcement. In practice we consider all three together. The further to the right we are on each spectrum, the higher the quality. Therefore, a transaction with a liquid commodity, at a key seaside port where the lender effectively owns the goods is ideal from a collateral perspective. On the other hand, because of the quality of this structure, the yield is likely to be low. Such a transaction is easily underwritten and will have high demand from capital providers, thus there is unlikely to be excess return in these structures.

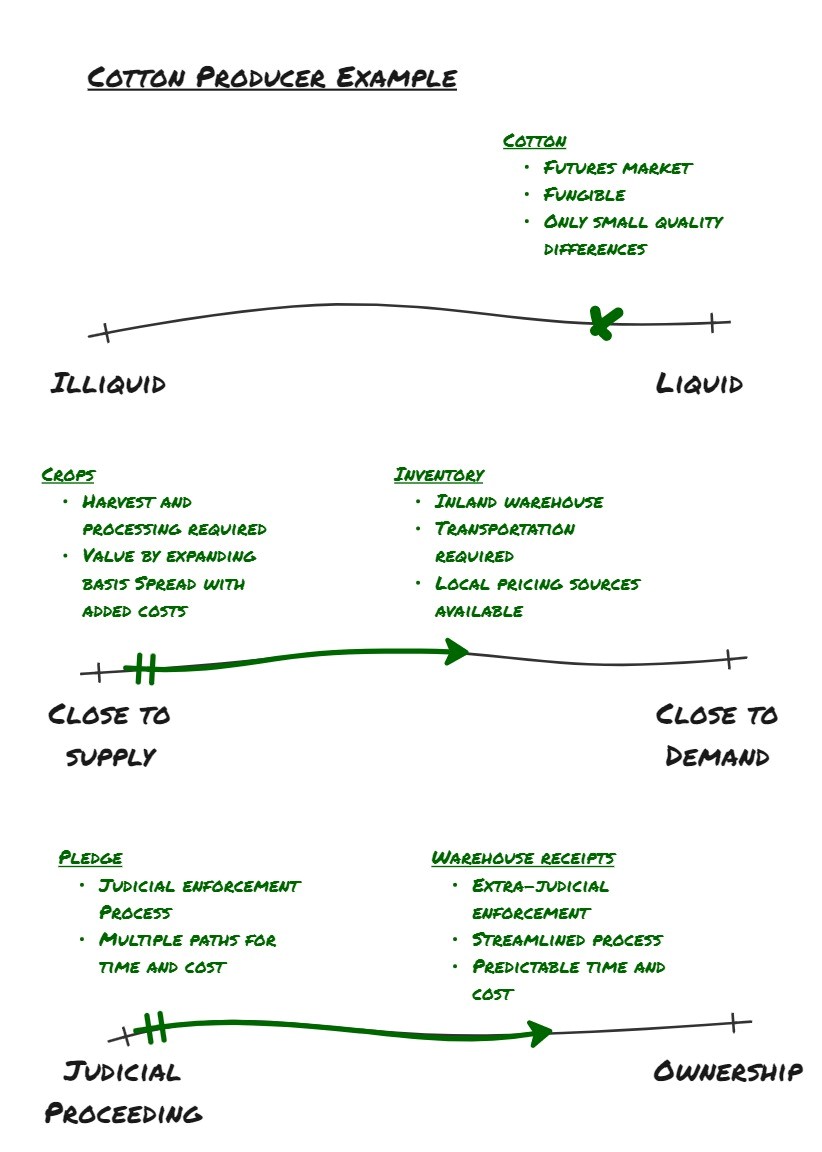

An opportunistic example of a transaction we often see follows the working capital cycle of a crop producer. The transaction starts with cotton crops, which are then harvested and processed into bales that are held in storage before they are sold. The structure is a pledge over the crops, which turns into extra-judicial warehouse receipts once in storage. One can imagine that in multi-faceted transactions like this one, there is more underwriting rigor required and therefore less demand from capital providers who lack this expertise. Therefore, there is opportunity for excess return. Let’s examine this collateral package using the spectrums.

The commodity at hand is cotton. There is a liquid and traded futures market for cotton, mainly underpinned by the ICE Cotton No. 2 contract. Quality of cotton can differ around the contract specifications, but not to a degree that we’d consider these different subtypes. Rather the quality differences result in predictable premiums/discounts. In a practical scenario, the cotton can likely be sold in its entirety without having to search for different buyers due to differences in specifications, making it fungible. The commodity location is variable, moving from crops in formation to cotton held in inventory. Similarly, the legal structure changes from a judicial pledge over crops to extra-judicial warehouse receipts. Here’s what that looks like, the green marks denoting each aspect of this collateral:

In this real transaction example, we note that the collateral quality improves as the season progresses. The cotton season for this producer starts in January when crops are planted. In June the harvest begins, and for a period the collateral package will turn from crops to inventory, with a mix of each until August. Importantly, this shift from crop to inventory requires processing through a cotton gin. If crops require processing, part of the analysis should also include proximity to processing facilities. In this example, there are numerous cotton gins within an hour or less drive of the crops. Every node along the supply chain should be understood to properly assess collateral. Once processed and stored, collateral shall be in the form cotton bales held in inventory. To accommodate for this, we use a higher collateral coverage ratio for crops, and then we accept a lower coverage ratio once goods are held in inventory. Our next step is to layer this with quantitative analysis of the underlying commodity, in this case, cotton.

Our analysis of the cotton market is lengthier than can be written here, but we will summarize. First, and perhaps most importantly, we note that cotton in the producer’s country has no dependence on government protectionist policies, and there is little interventionism that takes place in the market. If this were on a spectrum of its own, it would be in a near-ideal state. In terms of supply and demand at the time of this transaction, the stocks-to-use ratio for cotton was relatively low falling from around 95% at the end of the previous season to around 73% the next year, driving prices higher. The high price-low supply scenario is a fair one, founded in classic supply and demand analysis, thus we deem the market to be in a relatively fair state at this time. In considering the forecast of cotton prices, we note that supply shocks are typically to the downside. Market expectations are usually based on average-to-good weather, while extreme weather events are considered only once they arrive. This results in price shocks that are normally to the upside, as expected supply is decreased in these events. Thus, cotton price risk in this scenario is acceptable.

A note on Crop Risk:

Some may at this point ask themselves: what about the transaction’s crop risk? A transaction that holds crops as collateral is naturally exposed to crop risks, as in this example. However, there is often a misconception of the degree of risk. A crop event that results in lower global supply by 1% is newsworthy and has impacts on scarcity and price around the globe. A crop event that results in the same degree of loss at the transaction level is immaterial when considering typical overcollateralization rates of 130% and more. But what if the crop event hits the region you’re invested in specifically? Can’t the degree of loss be larger? Yes, it can be larger than 1%, but it is not as high as one might believe. Our experience, mostly across Latin America and Eastern Europe, suggests that reliable producers located in established growing regions may suffer losses up to 20% in their worst years. We recommend addressing each crop individually, looking at regional yields and the producer’s yields over a long history to determine what downside crop risk could be. Use this analysis to set overcollateralization ratios that cover this. Overcollateralization alone should be capable of covering crop risk. We do not recommend relying on this alone though. There are a multitude of tools to use to secure crops held as collateral and hedge out the vast majority of crop risk. Here are a few we use often: (i) overcollateralization rates for crops should be higher than for inventory, (ii) valuation of crops should use very conservative yield assumptions early on in the season, (iii) third-party collateral agents on the ground checking on crop quality periodically to drive yield assumptions, (iv) continuous weather monitoring by investment maintenance team, and (v) bolster collateral package with other assets during the growing season. In our experience, having executed and managed dozens of similar transactions, a crop event has never resulted in under-collateralization. Moreover, a reduction in commodity supply due to a lower crop should increase prices of that commodity, especially if a crop event occurs in a key production region.

Continuing with this example, we’ve defined the collateral by the three aspects and determined that the cotton market represents an acceptable level of price risk. But is the transaction investible on this basis alone? In some cases, the collateral can be strong enough that in and of itself, a transaction can be pursued. An example of this would be a structure where all the aspects are leaning on the right side of their spectrums. For most transactions, the underwriter cannot stop here. Our approach includes full analysis of the credit and operations of the borrower. In this instance, the borrower’s operational reliability is variable in the quality of collateral. This is a nuance that is often forgotten in working capital transactions. For this reason, we recommend that transactions are pursued with producers applying precision agriculture techniques, which are data driven and improve yield reliability each season. The appropriate approach to operational due diligence along the agricultural supply chain shall be a topic in a future whitepaper.

Driven by our collateral analysis, a transaction is structured that considers all the factors we’ve discussed. First, we set the overcollateralization ratios higher for crops than for inventory, to accommodate for the added frictions in crop production. Second, a fixed asset (farmland in this case) was added to cover the entire principal amount of the loan. This gave the lender enough comfort to grant the borrower some flexibility in legal structure to move crop to inventory with ease throughout the tenor. Lastly, we married the borrower’s hedging policy with the timing of contract assignments for the sale of cotton. This respects their hedging process while adding self-liquidation to the transaction through assigned offtake agreements at a reasonable time of the season.

Collateral Valuation and Maintenance

The maintenance of a loan position in an agriculturally backed working capital loan can be fairly involved. In this paper we speak strictly about maintenance as it pertains to agricultural commodities held as collateral. In this sense, we believe the best starting point for maintenance is understanding valuation of the underlying commodities held as collateral.

The value (V) of collateral is price (P) multiplied by quantity (Q):

V = P * Q

This is a simple calculation when you have goods in inventory, surveyed by a third party, and located at a key delivery point. The third-party collateral agent certifies quantity of goods, and the price is reliably correlated, if not the same, as the traded futures price.

Let us move back to our earlier example where the collateral starts as a crop. In this case, the quantity is a calculation of expected yield (Ye) multiplied by area (A). Area is simple, this is contracted and defined in legal documents. To measure expected yield, we look at historical yields of the borrower to determine ranges and variability. We use a third-party collateral agent who employs agronomists that are on the ground. These experts check the fields to determine a conservative yield expectation. Right after planting, expected yield is discounted by up to 30% of what the borrower expects to harvest in a few months’ time. The third-party collateral agent is employed to check on the crops periodically. As crops develop, the expected yield rises towards a regional average. Every valuation exercise is accompanied by a reconciliation of the collateral agent’s expectations with the borrower’s historical performance and current regional conditions. Importantly, yield expectations are discounted early in the season and only rise as the certainty of yield increases throughout the season, this is perhaps the biggest mitigating factor to crop risk. In the earlier example, we spoke of cotton. In that real life example, the early expected yield assumption was the same as the borrower’s yield in the year of its worst drought. Therefore, the borrower pledges a significantly higher area to the lender at the beginning of the season, to meet the collateral coverage requirement under the assumption of its worst yielding year.

Determining the price of crops is also not as simple as looking at a futures price, or even a local price. We need to accommodate for the cost of turning these crops into their marketable product, which is what is referred to in the futures price. To do this we work backwards to accommodate costs, such that P equals the futures price (PF) minus transportation and harvesting costs (C). The futures’ price is publicly available in real-time. Transportation and harvesting costs can move throughout the tenor, but not with the same severity as futures’ price, where speculators have influence. Thus, we determine a range of for these costs on a per ton basis, and then use the higher end of this throughout the tenor of the loan. Noting that the period where harvesting and transportation costs are the highest are at harvest time itself.

Therefore, for crops, the formula for determining value of collateral is:

V = (PF – C) * (Ye * A)

The above formula is similar for any crop, and the approach is the same for any commodity along the supply chain. That is, to accommodate for costs and basis in the price, and for potential loss in quantity.

In explaining the valuation of collateral, we’ve touched on most of what is required for collateral maintenance. The only question remaining is the frequency of valuation, and therefore revisiting each of the assumptions we’ve discussed. The easiest assumption should be revisited daily, that is the futures price. This is a quick exercise and with the right systems, can be automated on an investment team’s dashboard so that it is in real-time. Quantity is determined by a third-party collateral agent, which every deal of this type should have. For crops, quantity is affected by factors of nature, and therefore we suggest checking on crops approximately once a month, while retaining the right to check more often if necessary. This frequency is appropriate for just about all crops and the right to inspect them at any time gives the flexibility for the lender to send the third-party agent if adverse weather conditions develop. Both the collateral agent and the investment team should be tracking weather conditions on an ongoing basis.

For inventory, we recommend frequency of collateral agent checks to be weekly. These goods are truly movable. Therefore, it is important to ensure they are indeed in the designated storage facilities that are covered under the legal documentation. While it does not happen often, borrowers may move goods against the rule of the legal documents. This type of activity can happen when borrowers become distressed. This is where collateral maintenance is married with relationship and credit upkeep. It is important to remain in contact with borrowers to get regular updates on their circumstances beyond their regular reporting. Similar to the approach for crops, the lender should always retain the right to check on collateral whenever it wishes. If the lender believes the borrower is becoming distressed, it should increase the frequency of collateral checks, or have the collateral agent sit with the inventory 24/7. In ownership and quasi-ownership structures, a third-party is always in possession of the goods, so frequency of checks is naturally 24/7 in those scenarios.

In general, the maintenance of collateral in these types of loans includes constantly revisiting the commodity’s market, including daily price checks; communicating with the borrower and collateral agent frequently; following local market conditions including weather; maintaining a list of buyers who you can rely on; and speaking with anyone else in the local market.

Nord45 Partners

Andrew Pelekis, CFA

Partner

Nord45Partners ©2022