Introduction to Operational Due Diligence for Agricultural Producers

In this whitepaper we continue our journey through our multi-faceted due diligence process. Our approach breaks down investees by business type, into three broad categories: producers, processors, and traders. This paper is focused on producers, and the next editions will each focus themselves further up the supply chain on processors and traders. Distinguishing between each is not always straightforward. . In following editions, we will also narrow the scope to focus strictly on operational due diligence and the different considerations that are made depending on where the underlying investee sits within the supply chain.

A producer is a business where the company is growing agricultural product that depend on the passage of significant time to increase in value. By example, these can be crop producers, cattle ranchers, and shrimp farms, amongst numerous others. A processor in the agricultural supply chain is a company who buys feedstock to be put through a processing asset to increase its value. An oilseed crusher is a common example of this; that is, a company buying sunflower seed, for instance, and crushing it into sunflower oil and meal. Lastly, a trader is a company who neither produces nor processes but may add value through storage and logistics. Alternatively, some traders are exceptionally asset-light and merely pick up smaller margins by connecting buyers and sellers and arranging for transport by third parties.

Some companies are vertically integrated such that they operate across multiple nodes within the supply chain. This should come as no surprise. While the approaches described in each edition will apply to these vertically integrated businesses, the weight of importance allocated to each node will differ. For instance, a producer of sunflower seed may also have its own crushing facility, and thus is both a producer and processor. As a starting point, we assess the importance of each side of the business based on its margin contribution to the whole. But one would be remiss to ignore that without sunflower seed, the crushing operation may have no feedstock. Similarly, the margin on merely producing sunflower seed may be inadequate for covering the capital costs of maintaining a crushing facility; crushing margins may not always be positive. Then, it is clear that the degree of dependence and integration between multiple business lines is also important, and both sets of analysis are necessary.

Lastly, a risk assessment is required for every part of a company’s business, regardless of its importance to the bottom line. Take the example of our established sunflower seed company, who recently purchased storage facilities in a new region as a means of expansion. The throughput from this new storage facility may be immaterial to the larger business, but the risk is not. This storage facility will give birth to new opportunities in buying and selling other grains, a common and likely necessary approach to the management of this asset. This is a new business, one that requires its own risk assessment, for it is easy to hold on to a product in storage and over-expose yourself to price risks. Therefore, risk is not just a matter of the size of each of the investees various branches but can be hidden in what appear to be immaterial places. Be wary, be thorough, ignore nothing.

Producer

The most common business type in this edition is producers of row crops, like grains and oilseeds. These companies rely on vast swaths of farmland, favorable weather, and the passage of time to create value. While weather and time are not controlled by the grower, good producers can maintain above average yields with far less volatility than their peers. This is possible through the proper use of technology, including planting and harvesting machinery, precision agriculture equipment that provide reliable data, and the latest inputs and seeds that are more resilient to droughts and pests. The employment of agronomists is essential to decipher and act upon data to maximize timing of planting, replanting (if needed), application of seeds, and other inputs to ensure the strongest crop yields.

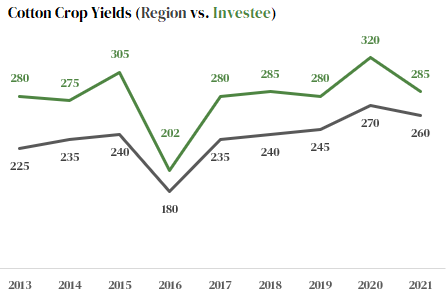

How is a financier to assess the quality of this technology? Our preferred approach is to look at historical crop yields of the company, breaking this down by region, and then compare these yields to regional averages. The ideal circumstance is for the company’s crop yields to consistently outperform the regions in which they operate, and to show less volatility. Regional data often includes smallholder farmers who do not have the same capital resources as a commercial crop production company, therefore outperformance relative to the region should be obvious and imperative. Below is an example of acceptable crop yield history of a grower relative to the region in which it operates.

The analysis above includes a year of drought in 2016 and is nonetheless acceptable. Without the regional comparison, one might arrive at a different conclusion. While the analysis above is straightforward and the example doubles down on this simplicity, we note that an acceptable investee may have a crop yield history with years where the grower underperforms its region, despite its advantages. It may feel easy to chalk this up to a one-time occurrence that is unlikely to reoccur; however, it is better to dig into this data point further. These occurrences can be due to numerous issues, including remote weather events, misapplication of inputs, incorrect timing, and/or lack of working capital. While some may have been avoidable, an unknown risk that has become known should be hedged thereafter. Often the solution to this is precision agriculture.

For producers, the most important

operational aspect is examining

the reliability of their crop production

Precision Agriculture

Over the last decade, precision agriculture has become more accessible to commercial farmers. So much so, that there is little excuse for even medium-sized producers not to employ the basics. There are many facets to these technologies, and they continue to improve year-over-year. In 2016, Goldman Sachs wrote “…the world has once again reached a tipping point in its long-term food supply problem. The next leg of food production growth will come from greater precision in agriculture […], with advances in hardware, software and computing power converging with technologies like self-driving tractors and drones…”[1] While this rhetoric sounds like antiquated Malthusian thought, and perhaps too much so, it does bear merit from a competitive standpoint. A producer who does not employ these techniques will quickly become less profitable than those that do, and in time shrink or all-together crumble.

Picture 1: On the ground agronomist reviewing precision agriculture data. Large producers operate across a number of regions that may not all be contiguous. Each should have its own systems and teams to gather data and make decisions at the micro level. A centralized decision-making process does not work well across multiple regions. Precision agriculture empowers teams to make optimal decisions at the micro level. With the advent of GPS and satellites, there is no region too remote to deploy these technologies.

Precision agriculture is the use of technology to farm each parcel of farmland individually and optimally. On the one hand, we’ve seen growers using autonomous precision machinery equipped with cameras, field sensors, and drones that provide seed-by-seed data across tens of thousands of hectares of land. This immense data is analyzed constantly by a team of PhD-level agronomists, who make informed decisions on ever-smaller parcels of land. Farming equipment can be programmed to automatically spray seeds that require more nutrients on a seed-by-seed basis when they are passed over by autonomous machinery. This is perhaps the apex of precision agriculture today, although in a year’s time it may not be, as the sector is growing quickly, alongside advancements in artificial intelligence and data analytics.

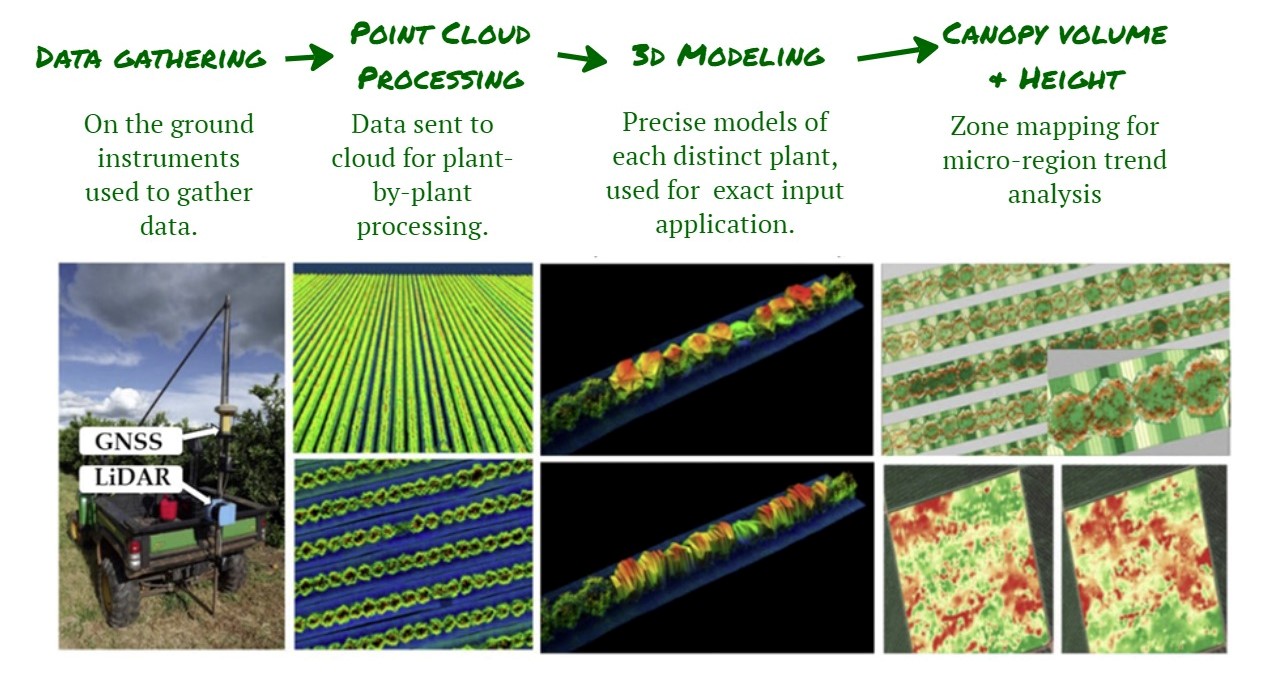

Companies like Google and Amazon have built out their data analytics to serve the agriculture sector, as the computing power can be immense. Take the example below of precision agriculture applied to an orange grove, where 3D models are generated that display different zones of each tree, as well as micro-region trends. This data is gathered throughout the season and must be calculated relatively quickly for it to prove useful. We use this example to define a high pole, but what bar can we use to measure the lowest acceptable level for an investee?

Given our earlier starting point whereby the producer consistently outperforms the region but may certain years where this is not the case, it is likely that they are already employing some form of precision agriculture techniques. The most common are automated machinery for planting and harvesting of crops. Existing machinery can be retrofitted with this technology; thus, the added cost is often bearable relative to the improved production. Importantly, this level of precision means that pesticides and fertilizers are sprayed exactly where they need to be, reducing input costs. The use of drones to survey large parcels of land is also fairly low cost but may require technical expertise that must be learnt. Data collection using field sensors which can track moisture, soil nutrients and provide soil mapping become more expensive, but can have the highest payoff when coupled with a team of agronomists. Lastly, the use of the latest seed varieties is imperative, and while a marginal increase in seed costs may feel high, it can act as a big contributor to reducing crop yield volatility.

Our view is that producers should be at the very least using the optimal inputs available to them in their region, with the next level of investment being in automated machinery. Beyond this there may be higher requirements for capital expenditure, but producers should be planning for this today.

For producers, the most important operational aspect is examining the reliability of their crop production. If one cannot determine that reliability is acceptable, then this may be time to reconsider the investment, depending on what part of the risk curve the investor is targeting. For investors seeking a higher risk-return profile, there is opportunity to investing in improvements in capital assets that contribute to improved precision agriculture techniques. This is assuming that the other aspects of the operator are satisfactory.

Regional Choices

We began under the assumption that the investee operates within a region that itself is acceptable; however, this is not always true. There are regions where crops are produced more reliably than others, merely as a consequence of its weather. The opposite is true too, some companies operate on the periphery of quality regions for their particular crops and therefore bear higher crop volatility. Understanding the region’s yield reliability is similar to the micro-level of understanding the investee’s – we compare the region to other adjoining ones and to larger regions as a whole.

In Mato Grosso, Brazil, farmers can double crop, often planting soy in the spring, and then corn or cotton in the summer. The ability to double crop spreads seasonal risk across two crops rather than one. To the east is Bahia, where there is also a thriving farming community; however, double cropping is not in the cards due to weather constraints that mean their growing season is shorter. While both regions are certainly investable, it is clear that there is more forgiveness in Mato Grosso then in Bahia.

Similarly, there are two broad regions in which sugarcane is grown in Brazil: one in the southeast and one in the northeast. While both may be investable, the southeastern region of Brazil benefits from more reliable yields than the north. Thus, this must be considered in one’s analysis, as merely comparing a sugar producer in the north to its peers in that region, forgets that an inferior producer in the southeast, on its own relative basis, may in fact be the better investment.

Regional choice for producers is driven

by crop yield reliability and

the availability of logistical networks

Aside from crop yields, one must also understand the logistical networks available to the producer in the region in which it operates. Access to storage is important, and access to reliable transportation networks further reduces risk. It is almost always superior for a producer to be located near waterways, where transport by barge or ship is cheapest and most reliable. Producers are often located far in-land so this is not the case most of the time, rail is the next cheapest option, but depending on the country can lack reliability, and lastly one must look at roads and trucking. This last option, while the least favorable is often the most relied upon, so understanding the length of the journey to delivery points and access to trucks is a necessary part of one’s analysis. At the time of harvest, these assets become scarce, and highways can become clogged with numerous trucks. Large producers sometimes own their own trucks to mitigate these risks.

In the same context, understanding the point of delivery for the producer is imperative. Producers operating in saturated areas may have access to in-land buyers who will offtake goods at the farm or local storage facility itself, thus the bulk of logistical risk is passed on. On the other hand, producers may opt to deliver goods at ports situated far away in order to achieve higher prices for their goods. This added reward comes with the logistical risks we’ve described.

Under a global strategy, in which the investor can choose not just within the borders of a particular region or country, but across different hemispheres, the investor has broader choices. Considering yield variability and logistical networks across the globe empowers the investor to make optimal choices and diversify accordingly. Of course, once you consider investments in different countries, there are a plethora of other risks that must be considered aside from yield reliability and logistics alone. The assessment of country risk and its implication to investments across the agricultural supply chain are not being addressed in this whitepaper, as this represents a topic all to its own.

Price Risk Management

Yield is important, but the price the grower sells their goods at is perhaps equally as important. A crop producer is naturally long the commodities it is producing, this is the case no matter how you cut it. A grower may be hedged for its current crop, but there is a season that comes after that, and another after that. The longer the investment horizon the harder it becomes to hedge out price risk over its term. The approach to price risk management then is to ensure hedging policies are in place, and that governance is strong enough for them to be respected. Even for a seasonal transaction, the producer is long for the bulk of that season.

Producers are just about as far down the supply chain as one can be, which means they bear the most price volatility. This is a consequence of somewhat fixed intermediary costs, such as brokerage fees, tariffs, and even freight. The producer is selling farmgate, and therefore bears these costs regardless of market price movement. Say, for instance, that a ton of corn is selling at US$300 FOB Santos and declines in price by US$30/ton, a 10.0% decline. The grower has intermediary costs for transport, fees, and tariffs of around US$40/ton. The move from US$300/ton to US$270/ton represents in fact a change from US$260/ton to US$230/ton for the farmer, this is an 11.5% decline. In this example, the producer’s price move is 15% more. Statistically speaking, the coefficient of variation (CV) of corn, calculated using futures’ prices, is about 38%, but if we assume a US$40/ton fixed intermediary cost between this price and the farmgate price, then CV is 51%[2]. Be aware that the further the producer is from its price, the wider its basis spread, and the higher its price volatility will be.

Generally, the further a node, or company, is upstream of the supply chain, the more price variance it will experience. At the producer level, there may be years when breaking even is a strong result, while other years may see operating profit well above what is possible for a processor or trader. In some extreme years, as was 2021, some quality producers achieved operating profit margins of over 40%, while respecting their hedging policies. That is, without taking undue risk. The importance of respecting one’s hedging policy and reducing price volatility to the extent possible remains imperative in the short and long term.

…the further the producer is from its price,

the wider its basis spread,

and the higher its price volatility

Producers may be tempted by rising prices and choose to remain unhedged longer than what is normal in an effort to lock-in ever higher margins. We discuss this at length in our February 2022 Whitepaper: Lending in Elevated Commodity Price Periods. In that paper we describe reckless overspending when capital is abundant. There is another issue, which is the inverse. A producer who is unable to manage its price volatility, either by its own misguided choices or lack of expertise, will not have the capital necessary to invest in its own required capital expenditures. Thus, years of lower revenues will have knock-on effects as the producer may have less capital to invest in quality inputs and capital improvements that are needed to compete as precision agriculture continues to permeate across the sector. This would unveil itself over time in our earlier crop yield analysis, as the gap between regional averages and the producer’s becomes smaller, or negative.

Managing price risk for producers is a matter of selling physical long exposure throughout the season. The producer cannot sell the entirety of its production forward, as yield expectations change from pre-planting to harvest. As the producer approaches harvest, yields become more certain and thus a larger portion of production should be sold forward, or in other words, hedged. Instead, futures can be used to hedge until a physical forward contract is put in place. When examining hedging policies, the producer should take into account its planting and harvest scheduling, and hedge using liquid futures contracts and forward sales. A forward sale is a better hedge, as it is directly correlated to the physical product being sold; however, contracting these sales at the beginning of the season is often impractical, thus futures with strong correlation are utilized instead, and covered once a forward contract is put in place.

To assess the investee’s hedging policy, it is best to look at how long the policy has been implemented and examine the producer’s price volatility over this timeframe relative to the market itself. The analyst should also examine break-even levels for each crop on a per ton basis, and reconcile this to the hedging policy itself. A prudent approach should be taken such that breakeven costs, including financial costs, should be covered with early hedging. A more opportunistic approach is not unreasonable after break-even is met, keeping in mind that capital expenditures may be a requirement for necessary yield improvements to remain competitive.

Organizational Structure & Governance

Agri-commodity production businesses often employ numerous people and are spread across a large geography. Thus, a clear and delineated organizational structure is necessary to manage businesses of this breadth. Examining an organizational chart is the first step, but understanding the reporting structure through questioning of managers across the firm is also important. Visiting farms, speaking with the local managers and individual workers to verify how decision making is made at the micro level, and then reconciling with mid-managers and executives is a natural part of onsite due diligence. “Natural” because an interview process is too formal and often results in answers being given that the investor wants to hear, rather than the practical reality. We visit regional offices, farms, and headquarters and speak to as many of the company’s workers as we can along the way, whether they are managers, agronomists, or executives.

Strategic decision making, including annual planting schedules, hedging policy changes, and new offtakers should occur at the executive level, with reporting flowing into a Board of Directors. The Board should include key members of the day-to-day management of the company, such as the CEO and Head Trader, along with independent members, and key shareholders. A critical part of the Board is that it is not overwhelmed by nepotism, nor does a single shareholder control decision making. Nepotism is often easy to spot, and similarly easy to avoid. Centralized decision making masked by proper governance policies, at least on paper, is a matter of judgement and time. A rushed due diligence process may not unveil such an issue; however, if one asks a multitude of questions, interviews key managers, performs onsite visits, negotiates a transaction, and goes through a closing process, over this period a figurehead may unveil themselves. Remain conscious of this issue throughout your due diligence, as it may reveal itself over time. Perhaps the most important decisions that rest within the upper echelons of a hierarchical corporate structure for producers, is the hedging policy itself. Thus, reviewing this policy, and understanding how changes are made to it, and how it is respected is critical. Policy changes should be to help mitigate risk, rather than allow for more opportunistic price searching. Expansion of unhedged risk inside of the policy should be coincident to the producer’s volume growth. Inversely, if volume decreases, allowable outstanding unhedged risk should also decrease. No individual trader should be allowed to act alone for a sizeable producer, as the job entails selling physical goods and covering futures, not opportunistic trading. Given that yields and thus volume become more and more certain throughout the season, the timing at which trades occur does not require any single trader to have an immediate sign off. Therefore, multiple signoffs for big trades and a lack of individual autonomy does not reduce opportunity, but it does increase risk mitigation.

…delivery points are not just at ports,

many buyers exist in highly saturated in-land areas

where crops are abundant

Loan Structuring & ODD

The operational due diligence is imperative to structuring a transaction with a producer. Crop yields and logistics need to drive critical choices. If one is collateralized by crops and crop yield variability is high, then considering this in your collateralization levels is important, as the investor needs a bigger cushion, or a lower loan-to-value, in order to absorb the higher possibility for downside case scenarios. Looking at the investee’s crop yield history alone leaves a missing variable, that is, the producer’s expected crop yield at the beginning of the season. This is likely the level at which the lender will value collateral early in the transaction, and thus it is from this point one measures downside risk. Measuring downturns from this point in the producer’s worst years and setting overcollateralization levels such that one is covered in these cases will result in the highest level of protection. This is not always possible, so the investor should be measuring collateral levels on at least a weekly basis, and top-up as often as needed, setting a lower edge of acceptable collateralization that itself has a strong buffer.

In price risk management, we describe the difference in volatility between goods held further from delivery points, and thus the degree of potential downside in collateral value is affected by location as well. This should be considered similarly in setting overcollateralization rates. That is to say, there are costs to selling goods, even after they’ve been enforced by the lender, and these should be considered. We have structured single transactions with multiple locations where collateral is held, setting a smaller overcollateralization rate at a river port then in-land. This is well understood by participants in the agriculture sector, so this type of dynamic structuring is often negotiable.

Similarly, the investor should examine all the offtake contracts used to self-liquidate the transaction, paying particular attention to delivery points. As mentioned above, the point of delivery impacts costs and price variability, and both must be considered when structuring a deal. Delivery points further from the point where goods are held as collateral result in added friction and delivery risks in the event of enforcement. The investor should note that delivery points are not just at ports, but that many buyers exist in highly saturated in-land areas where crops are abundant. Therefore, mitigating delivery risk entirely, even in-land, is often possible.

Lastly, if governance is not up to par, it is possible to add covenants that force the investee to make material changes in this area. This can be the addition of an independent board member, or even the creation of board altogether. The influence the investor has in this area is dependent on the size and necessity of their investment as perceived by the investee. While these covenants are harder to negotiate, a longer-term relationship between the parties can make this amenable.

Conclusion

Producer’s value-add comes from their ability to reliably produce agricultural goods, whether it be row crops, permanent crops, or animals. Due diligence should focus on proving this to be true over long periods of time, including resilience during droughts or other crop events. Beyond that, we do not want to see an excessive amount of margin coming from third-party trading, or protracted periods of unhedged physical positions. While either of these may contribute to growth, they stray from the core business and introduce unnecessary risk. If such risk is deemed acceptable, so-to-speak, then you are not doing business with a producer, but with a trader. This requires a different approach entirely – one that we will tackle in our next Whitepaper.

While much of what is discussed in this Whitepaper applies to the lending business, the same due diligence can be applied across numerous capital structures.

Nord45 Partners

Andrew Pelekis, CFA

Partner

Nord45Partners ©2022